In his first speech since being promoted to lead China’s dominant e-commerce company last week, Alibaba Group CEO Daniel Zhang yesterday told employees that international expansion is a top priority in the coming year.

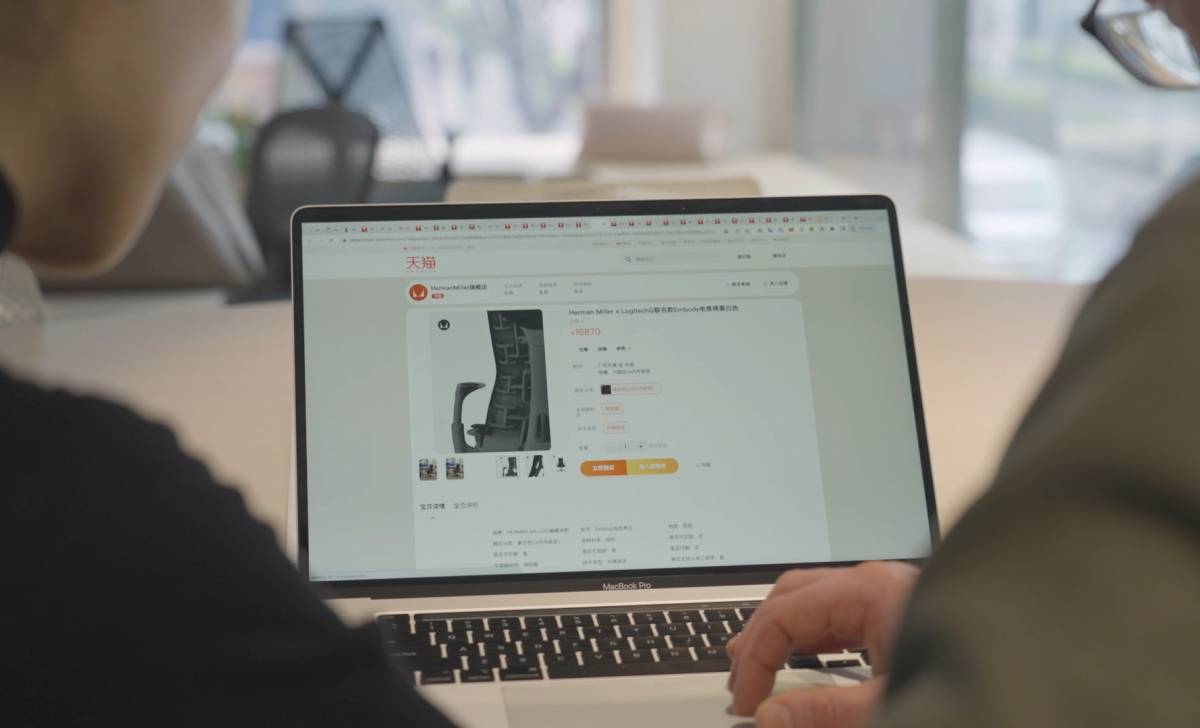

“We must absolutely globalize,” Zhang said during a company-wide strategy session at the company’s Hangzhou, China campus. “We will organize a global team and adopt global thinking to manage the business, and achieve the goal of ‘global buy and global sell,’ ” he said, adding that Alibaba would continue to invest heavily in new and existing overseas operations including AliExpress, a cross-border online marketplace positioned to sell Chinese goods to consumers all over the world, and Tmall Global, which helps foreign brands sell online directly to Chinese consumers.

Zhang, 43, an Alibaba veteran who speaks nearly fluent English and has experience working with international brands and investors, stressed that globalization “is not just a slogan.” The effort will reshape the demographics of Alibaba’s overwhelmingly Chinese workforce. “We need to have global talent” he said. “We will have employees from all over the world that look different from each other. We have to take the time to understand them to understand their habits, cultural differences and way of thinking. This is how we become truly an international company.”

“Today, you can say Alibaba is in the process of achieving globalization,” he said. “Over the next five, 10 years, 30 years, this is the journey. We must absolutely globalize and it must be a successful effort—if not Alibaba won’t be able to last” for more than 100 years, one of Alibaba Executive Chairman Jack Ma’s loftiest corporate goals.

Ma has other ambitious goals, such as reaching $1 trillion in annual GMV generated on Alibaba’s e-commerce marketplaces by 2020. The company last week reported it generated $394 billion in GMV on its China retail marketplaces in its fiscal year ended March 31. Zhang yesterday said that to get to $1 trillion, Alibaba needed to continue to focus on building sustainable businesses rather than simply evaluating success by scale.

“Can we still create entrepreneurs and new original brands, or build Chinese brands selling quality products on ‘almighty Taobao’, and can this platform continue to grow? These are our concerns,” Zhang said. “When we face issues like counterfeit goods and brushing, are we able to step up and improve our market-monitoring mechanisms and to perfect them in order to effectively combat these harmful products on our platforms? In order to reach our goal of $1 trillion in GMV, we need to transform our platform into a high-quality, thriving platform.”

Among Alibaba’s diverse businesses, Zhang singled out Aliyun, the company’s cloud-computing arm, for potential growth. The company already provides cloud and big-data analytics services to 1.4 million customers in China; Aliyun recently opened a data center in Silicon Valley and this week announced a technology joint venture in Dubai.

“This year, I think it’s very important that cloud computing keeps growing its number of customers, the quality, efficiency,” Zhang said. “Cloud computing is taking off, I have confidence that (it) can become as important as e-commerce and finance because big data is our basic, fundamental, important platform.”

Zhang also laid out broad-stroke strategies for other key business units:

Mobile: Alibaba during 2014 generated more than 80 percent of total mobile e-commerce GMV in China, according to iResearch. The company will press its advantage by continuing to develop its mobile Internet businesses as it integrates two major acquisitions: leading web-browser firm UCWeb and mapping business AutoNavi.

“Browsing and mapping are basic services in the mobile era,” Zhang said. Alibaba, which recently named UCWeb’s former CEO Yu Yongfu to run both of the acquired business units, are working on “seamless integration” of their staff and technologies, “enabling mapping data and services to become our basic services, the (mobile) browser to become an entry point to introduce traffic and users, and to integrate mobile search and P4P (pay-for-performance advertising),” Zhang said. “There is huge potential.”

“Over the past year, we have gone ‘all-in’ in mobile and the results have been good,” he said. “But a large part of the progress is due to the behavioral changes of our consumers. This year we want to help our merchants even more – help them have better business on mobile by enabling them to better manage their stores, their warehouses, user marketing and their CRM through mobile.”

Alimama: Alibaba’s e-marketing technology platform, which sells a range of advertising and marketing services to millions of Taobao Marketplace and Tmall.com vendors, “has been embedded in Taobao too long,” Zhang said. This year the focus is on expanding the reach of the company’s ad network to consumers and merchants outside Alibaba’s ecosystem.

“Today the real economy and the virtual economy are in the process of integratingand all enterprises ‚Ķ will be upgrading to digital marketing,” Zhang said. “We hope that after a few years of hard work, Alimama will not just serve Taobao e-commerce customers but have the means to use Internet marketing to target customers from all walks of life with products to entertainment to local marketing. All kinds of customers are able to take advantage of the large database and marketing platform that Alimama has to offer.”

Logistics: Through Cainiao, a 48%-owned affiliate, Alibaba Group operates a central logistics information system that connects a network of express delivery companies in China. Cainiao is using big data and cloud computing to help millions of small parcel delivery companies, distribution centers and warehouses coordinate the delivery of products ordered online throughout much of China.

Zhang asked: “How can we improve efficiency to help our businesses and help our logistics partners to better enhance efficiency, increase their customer service?

“This is a young team, only two years old and our road ahead is still difficult, we want the picture to become clearer and become broader to convey how Cainiao is helping with the important task of upgrading China’s business infrastructure and the entire logistics supply chain.”